Traveling can free your spirit and help you gain some distance from everyday matters. But on the other hand, a well-organized trip requires a proper arrangement. Also financial. So in this article, I share with you my Revolut review – the travel prepaid card that I personally use since 2018. And I show how you can use it to reduce your travel expenses.

Years ago, before I finally learned about how to be conscious of my finances and home budget, I was struggling with using my bank cards and spending money abroad. I knew that paying with my Polish debit card in other currencies cost me money. But I was not aware of the existence of any solutions. I even didn’t know how high was the exchange rate for my card. Does it sound familiar to you?

But when I started to travel more, I knew it was the time to upgrade my financial game as well. Then I discovered the Revolut card. And ordering it was one of the best things I could do for my travel budget.

Read this article to find out if Revolut will be right for you as well and find the answer to your question “Why should I use Revolut?”

Table of contents:

- Quick Revolut Review

- Revolut – what is it?

- – How I discovered Revolut?

- – What is the Revolut exchange rate?

- – How to save money with Revolut card?

- – Revolut currencies

- – Who is Revolut for?

- How does Revolut work? Quick tutorials for better understanding:

- – How to create a Revolut account?

- – How to transfer money to Revolut?

- – How to exchange money in Revolut?

- – How to withdraw cash with Revolut?

- Revolut card review:

- – How to order the Revolut card?

- – Is the Revolut credit card?

- Is Revolut free? What are the Revolut fees and Revolut card fees?

- – The simple rules for standard Revolut fees

- – Revolut plans comparison

- Revolut for travel – is it worth it?

- – Overseas Medical Insurance

- – LoungePass

- – Concierge services

- FAQ: Everything you need to know about Revolut:

- – Is Revolut a bank?

- – How does Revolut make money?

- – Is Revolut safe?

- – It helps you save money by creating dedicated vaults

- – Cryptocurrency

- – Revolut refer a friend – how it works?

- – Can I have a business account in Revolut?

- Revolut review resume:

- – Why I love using Revolut card

- – What I don’t like about Revolut

Disclaimer: This post contains some affiliate links. That means that if you click on them or make any purchase via them, I receive a small commission. But don’t worry, this will not cost you anything and in a few cases, you can even receive a special discount! And I will still be able to chase my dreams. So thank you!

Quick Revolut Review

If you’re looking for a highly effective multicurrency card to accompany your trips, Revolut is a great solution. By many people, it is considered as number #1 among the international currency cards. If you remember about a few rules listed below you can use it almost for free. Worldwide!

I personally use Revolut for the second year already. Many times it helped me to forget about currency issues and to travel with financial peace of mind. If you’re ready to reach the same level of travel finances mastering, ordering the Revolut card by clicking below is your first step on this path.

Revolut – what is it?

The obvious way to begin the Revolut review – let me explain to you what is Revolut.

In the simplest words, Revolut is a prepaid multi-currency card in which you can operate in a similar way to a traditional bank card, by using a dedicated Revolut app.

Your Revolut account is connected to your standard bank account from where you can send money immediately to the app. Once your Revolut balance is filled with money you can exchange it up to 31 currencies with only a few clicks in your Revolut app. It all happens in seconds so you can use the exchanged money on your physical card immediately!

The physical Revolut card, associated with your current Revolut account, lets you pay anywhere where Visa and Mastercard are accepted, in over 150 countries. You can also manage international money transfers and freely withdraw cash from any cash machine around the world! (you should only lookout for the hidden ATM costs – more on that later on).

How I discovered Revolut?

Before I get the Revolut card, I was also using a currency card from a Polish bank. Unfortunately, it covered only EUR currency, and to load it with money from my main account in PLN I usually needed to wait for a whole bank session (so a few hours at least).

But one day, I saw someone mentioning using Revolut abroad in one of the Facebook groups for digital nomads. Surprisingly, it had almost only positive opinions in this group.

So I decided to give it a try before my first big trip when I left for 2 months to the Caribbean. Revolut was there with me and did a perfect job!

What is the Revolut exchange rate?

While using a traditional bank card, your expenses in a currency different from the currency of your card are often charged with a bank exchange rate which is a direct bank margin for service.

Revolut exchange rate is much better for your finances because the app uses the interbank exchange rate. This is the same rate at which banks swap currencies directly between each other so there is no markup added to your Revolut money transfers.

Currently, Revolut adds a small markup of 1% only to Thai Baht and Ukrainian Hryvnia exchanges.

How to save money with Revolut card?

To understand better how Revolut can help you save some money on traveling, let me show you an example. We will compare the travel expenses for using both Revolut and my traditional bank card (with the main account in Polish Złoty, and with the bank’s markup on the exchange rate).

Our designed expenses:

- flights: 80€

- accommodation: 150€

- food: 75€

- activities: 58€

In total we must spent 80 + 150 + 75 + 58 = 363€.

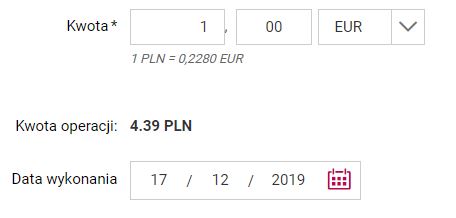

Now let’s compare the screenshots of exchange rates of Revolut and traditional bank for the day of 17.12.2019.

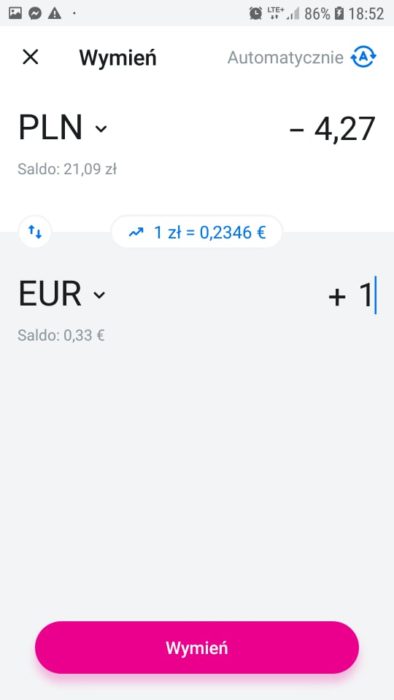

As you can see, the exchange rate difference is pretty big. 1 PLN in Revolut is worth 0,2346 € and at the same time, my traditional bank price it for 0,2280 €.

It means that in Revolut I can buy 1€ for 4,27 PLN, while in the bank – for 4,39 PLN. That’s the difference of 0,12 PLN!

Now you might say it’s just some cents literally. But let’s come back to our travel example. To afford our little trip I must spend:

- in Revolut: 1550,01 PLN

- in the bank: 1593,57 PLN

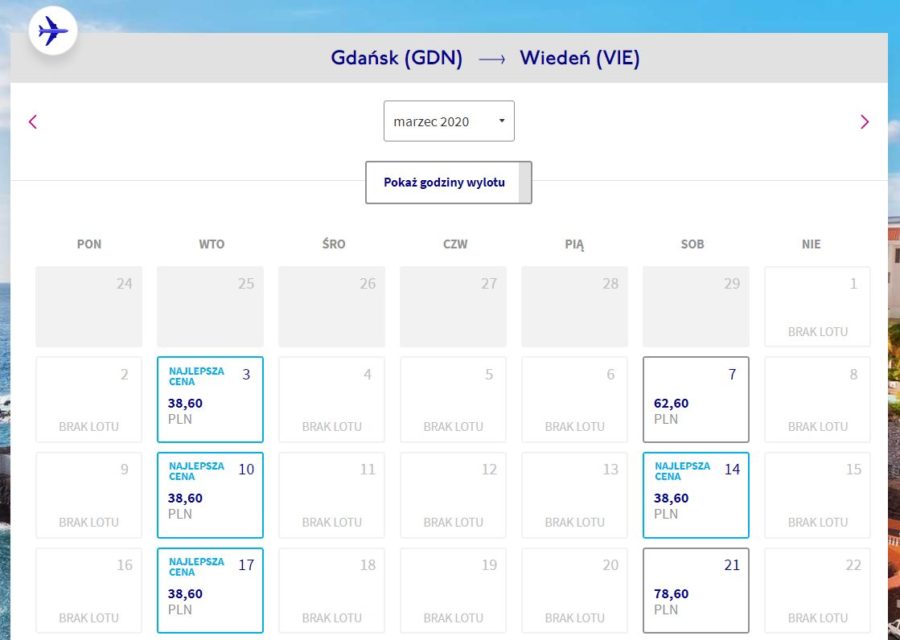

And that’s the difference of 43,56 PLN! And that’s already becoming a nice amount of money. For this price, I could buy an occasional flight ticket from Gdańsk to Vienna for March 2020. Did I get your curiosity already?

Read more: Wanna know more travel saving hacks? Click here to find my 15 best tips!

Revolut currencies

Currently, Revolut offers up to 31 currencies which practically allows you to pay in the most popular travel destinations with a single one prepaid card.

The actual Revolut currencies:

- AED ( The United Arab Emirates dirham)

- AUD (Australian dollar)

- BGN (Bulgarian lev)

- CAD (Canadian dollar)

- CHF (Swiss franc)

- CZK (Czech koruna)

- DKK (Danish krone)

- EUR (euro)

- GBP (British pound)

- HKD (Hong Kong dollar)

- HRK (Croatian kuna)

- HUF (Hungarian forint)

- ILS (Israeli shekel)

- ISK (Iceland krona)

- JPY (Japanese yen)

- MAD (Moroccan dirham)

- MXN (Mexican peso)

- NOK (Norwegian krone)

- NZD (New Zealand dollar)

- PLN (Polish zloty)

- QAR (Qatari riyal)

- RON (Romanian leu)

- RSD (Serbian dinar)

- RUB (Russian Ruble)

- SAR (Saudi Arabian riyal)

- SEK (Swedish krona)

- SGD (Singapore dollar)

- THB (Thai baht)

- TRY (Turkish lira)

- USD (The United States dollar)

- ZAR (South African rand)

Who is Revolut for?

Revolut card is a perfect solution for anyone who travels. I would not decide to write this Revolut review if I wouldn’t use Revolut to travel on my own. Revolut allows you to create virtual wallets in your app, where with a few clicks you can exchange currencies you need for your next trip.

Moreover, Revolut offers some additional offers for travelers, such as travel insurance, concierge service, or even the entrances to airport lounges.

But in fact, Revolut is great even if you’re not traveling at a moment. You can use it in your home country as well. Personally, I use it to make purchases online – when I buy, let’s say, ebooks or digital courses which have prices in dollars or euros, I use Revolut to save some money thanks to using interbank exchange rates.

Click here to get your Revolut account!

How does Revolut work? Quick tutorials for better understanding

Now, when you get the overall idea about how does Revolut works, let’s jump into some basic operation with the app and card so you can easily start your adventure with Revolut!

How to create a Revolut account?

Creating a Revolut account couldn’t be simpler. All you need to do is to submit your phone number on the Revolut website. Then, you receive a message with a link to download the app directly to your phone. The second step is choosing your passcode and entering your personal data with the home address. And this is it! You don’t even need to leave your house to create Revolut account.

After creating a new account you should also validate your identity by scanning your ID card and taking the photo of your face. You can do it by following the steps mentioned under “Profile” -> “Personal details”.

How to transfer money to Revolut?

In order to top up your Revolut account, you need to add your standard bank card information to the app. Once you do it, you can top up money from your main bank account to your Revolut account so they will be ready to use for foreign exchange, or making Revolut money transfer.

Always remember to top up money to the Revolut account in the same currency that is operated by your bank. In another case, your bank may charge you with its exchange rates.

How to exchange money in Revolut?

Exchanging money in Revolut is so simple and you can do it with only a few clicks. In your main dashboard click “Exchange” and then choose your currency. You’ll see the actual exchange rate. It changes a little bit all the time because it’s the real interbank exchange. Choose how much money you want to exchange, click the button and voila! The exchanged money you can use while sending transfers directly from the app or by using the physical card in the local currency that you chose.

How to withdraw cash with Revolut?

You can withdraw cash from your Revolut account in any ATM anywhere in the world. Nevertheless, there are some rules you should remember in order to avoid additional costs.

- Sometimes ATM might ask you to choose between “credit”, “checking”, or “savings”. Always choose “checking” or “savings”.

- ATM might also ask if you would like to withdraw cash “with conversion” or “without conversion”. Always choose “without conversion”. Otherwise, you might be charged by some additional fees by the ATM. You should always aim to withdraw cash in the local currency of the country you’re currently in. Of course, remember to exchange this currency in the app before the withdrawal.

Revolut card review

Once you downloaded the Revolut app, created your account, and loaded it up with the money, you can order a physical card as well.

I really regret I didn’t take a photo of my card when it finally came. The user experience of opening it was designed so exciting! This Revolut card review is not completely full without showing you the opening of the colorful box, cleverly designed to deliver your card. Only confetti and trumpets were missing. Well, you must trust me it was cool!

How to order the Revolut card?

Once you created your account and topped up some money, it’s time to order a physical card. To do it through the app, simply go to “Cards” -> “Physical” and follow the instructions. The delivery time for standard shipping is actually up to 9 working days.

Is the Revolut credit card?

No, Revolut does not offer credit cards. The card that is associated with your Revolut account is a prepaid card that you can load with a money transfer from the account in your main bank.

Is Revolut free? What are the Revolut fees and Revolut card fees?

Nothing in the world is free. But if you’re clever enough, you can enjoy many things for free. With Revolut it’s the same. Although in some cases it adds markups, there are no hidden Revolut fees for users. Here I explain to you how to use Revolut legally and efficiently during your trips.

The simple rules for standard Revolut fees:

- free cross-currency exchanges up to 5000 GBP per rolling month (during weekdays) – the exchanges above this amount applies with a 0,5% fee

- free cash withdrawals up to 200 GBP per rolling month – above this amount, a markup of 2% will be added

- a flat markup of 0,5% is added to most currency exchanges on weekends (some currencies such as Thai Baht and Ukrainian Hryvnia gets the 2% markup in total) – that’s because the currencies constantly fluctuates, and the markets are closed on Saturdays and Sundays. Thanks to this markup, Revolut protect itself against unusual fluctuations

So as you can see, the general Revolut costs are pretty simple. If you want to avoid them, simply remember to pay mostly by card and not by cash, and to exchange your currency in the app before the weekend. Easy peasy!

Click here to get your Revolut account!

Revolut plans comparison

Revolut fees mentioned above regard the Standard account which is in general free. But if you’ve got more sophisticated needs, Revolut offers two other accounts – Premium and Metal – which are dedicated to more demanding users.

| Feature | Revolut Standard | Revolut Premium | Revolut Metal |

|---|---|---|---|

| Free UK account | ✓ | ✓ | ✓ |

| Free Euro IBAN account | ✓ | ✓ | ✓ |

| Spend in over 150 currencies at the interbank exchange rate | ✓ | ✓ | ✓ |

| Exchange in 30 fiat currencies up to £5,000 per month without any hidden fees | ✓ | ||

| Exchange in 30 fiat currencies - no monthly limit | ✓ | ✓ | |

| No fee ATM withdrawals up to £200 per month | ✓ | ||

| No fee ATM withdrawals up to £400 per month | ✓ | ||

| No fee ATM withdrawals up to £600 per month | ✓ | ||

| Overseas medical insurance | ✓ | ✓ | |

| Delayed baggage & delayed flight insurance | ✓ | ✓ | |

| Global express delivery | ✓ | ✓ | |

| Priority customer support | ✓ | ✓ | |

| Instant access to 5 cryptocurrencies | ✓ | ✓ | |

| Premium card with exclusive designs | ✓ | ||

| Exclusive Revolut Metal card | ✓ | ||

| Disposable virtual cards | ✓ | ✓ | |

| LoungeKey Pass access | ✓ | ✓ | |

| 0.1% cashback within Europe and 1% outside Europe on all card payments | ✓ | ||

| Get access to a concierge to help you manage your lifestyle | ✓ | ||

| Monthly price | Free | $ | $$ |

| Get Revolut Standard! | Get Revolut Premium! | Get Revolut Metal! |

Revolut for travel – is it worth it?

In this section, I tell you about the most interesting additional Revolut services from the point of view of us – travelers. By using the Revolut app you can get access to Medical Insurance Overseas and the Lounge Passes. Interested?

Overseas Medical Insurance

Revolut aims to take care of its users. That’s why they offer medical insurance as one of their additional options. You can purchase it within a few minutes in your app by choosing one of two options:

- Pay-per-Day: you set up the days of your trip and you’re charged per each of the trip days

- Annual: you can purchase the whole-year insurance for 30 GBP

Revolut uses geolocation to count the insurance price for you which is so useful from the user’s point of view.

You can also extend your insurance by adding winter sports or covering your travel companions.

The Revolut’s insurance is provided by White Horse Insurance Ireland. To know more about travel insurance, click here.

P.S. I’ve been not using Revolut insurance yet so I cannot recommend you using it or not. Although, travel insurances are an important thing, so always think about purchasing one!

LoungePass

If you’re a Premium or Metal account user, you can get access to over 1000 airport lounges around the world. Revolut cooperates with LoungeKey Pass and gives you the possibility to easily book your pass for you and your travel companions via the Revolut app.

Concierge services

Concierge services are one of the most exclusive Revolut options dedicated to the most demanding users of Metal cards. After filling up your profile with personal preferences, you can easily contact the concierge customer service and ask for the recommendations and help with booking accommodation, restaurants, and events in your travel destination. Kind of luxurious, right?

FAQ: Everything you need to know about Revolut:

Here you find the answers to some common questions about this finance product. If you want me to add anything to this section of the Revolut review, leave your question in the comment section below.

Is Revolut a bank?

No, it’s not. Currently, Revolut is an Electronic Money Institution. However, Revolut already received a European banking license, but for now, it’s not officially a bank.

How does Revolut make money?

Although it seems like Revolut is almost free service, it still earns some money, mostly on Premium and Metal cards monthly fees. But also on small markups added in situations mentioned above, and on cross-selling of other services like travel insurance or concierge service. So in fact, the Revolut business model is a simple thing.

Is Revolut safe?

This is a question that any potential Revolut user should ask. At the moment of writing of this Revolut review article, Revolut was not a bank. It might be suspicious to give our money to a company like this.

But in fact, Revolut takes good care of the funds send to its accounts. In fact, the money stored by Revolut is actually directed to dedicated accounts in the British Lloyds Bank – a well established British retail and commercial bank. In case of any Revolut financial problems, your money will be refunded to you from this bank.

The Revolut cards are the propriety of well-known companies – Mastercard, Maestro, and Visa. Therefore, they are subject to their regulations.

In the end, we can say that using Revolut for spending money around the world is totally safe. The only thing that I suggest you not to do is not to deposit the savings of your life there. Revolut currently is not supported by any deposit insurance company. It means that if you’ll lose dozens of thousands of dollars or euros because of Revolut’s financial issues, you might have a problem with receiving them back.

So the savings I prefer to deposit in a traditional bank. But besides this, I found Revolut a great option to operate on the smaller amounts of money which I currently need for a trip.

It helps you save money by creating dedicated vaults

Besides my last words, Revolut still can be a good place to save money for smaller goals. Such as the next travel for instance.

In your Revolut app, you can create vaults for any goal you want. Simply fill them up with money whenever you want but you can also use clever help of Revolut. You can use a setting which saves some small change from any transaction you make with Revolut. Or, you can even set it up to double or triple each time! Thanks to this solution you can save money in your vaults almost without noticing it.

Cryptocurrency

The other interesting option for financial freaks is exchanging cryptocurrencies. Currently, via Revolut you can buy such cryptocurrencies as Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP).

This option is dedicated to Revolut Premium cards and Revolut Metal cards. If you’re a user of Revolut Standard, you can unlock the access to cryptocurrencies by inviting 3 friends to use Revolut.

Revolut refer a friend – how it works?

Referring to a friend in Revolut is super easy. Plus, you can receive a small bonus of doing so!

To refer a friend in Revolut, go to you your dashboard, “Invite friends”, and then simply choose a friend you want to invite. You can do it by entering a phone number or email. The special invitation message with your referral link (super important) will be sent to this person to help him create his first Revolut account.

Can I have a business account in Revolut?

Of course, you can! Revolut offers special business services for companies and freelancers. If your business (big or small) is an international thing, and you manage payments in different currencies, then Revolut Business is an option for you.

Currently, it allows you to use up to 28 different currencies. It also provides you with an intuitive app to track your international spendings of yours and your employees.

Click here to learn more about Revolut Business

Revolut review resume:

Personally, I found the Revolut app and card almost perfect for international traveling. I’ve been using it in many countries and it didn’t disappoint me. But still, there are some little details that I would improve regarding Revolut services. I finish this Revolut review with the section where you can see the pros and cons of using their accounts.

Why I love using Revolut card:

- The most important operations take only seconds or minutes to proceed

- Everything happens in a digital world – there’s no need to visit Revolut branches

- Revolut allows you to operate on multiple currencies which facilitate spending money in many popular travel destinations

- Using the interbank exchange rate helps you to save money in comparison with traditional exchanges in banks and cantors

- You can use different currencies with one single prepaid card

- The Standard account is practically free in use if you follow the rules

What I don’t like about Revolut:

- The only way to get into your account for individual users is to use the mobile app – it would be super comfortable to be able to do it on the computer as well

- I’ve heard that the offline card terminals sometimes have troubles with operating Revolut cards – it might happen on automated highway gates, in self-service petrol stations, or in the airplane

- Some ATMs might load you with additional fees on using Revolut – it’s not the Revolut fault actually, but I want to remind you about carefully reading ATM’s screen messages before withdrawals

- Although Revolut money transfer to the standard UK bank can take even 1 hour only, the thing gets complicated when you transfer money with the Revolut app internationally. This kind of transfer can take up to 3-5 working days.

Revolut review: is it worth to apply for the Revolut card?

In short words, for me creating a Revolut account and using the prepaid card is totally worth the trust in this company. I didn’t have a chance yet to enjoy all of their features, like medical insurance or concierge service. But the basic ones work perfectly for me and totally meet my expectations for travel prepaid cards. And I am convinced it will work for you as well.

If you have any questions about using Revolut, ask them in the comment section. I’ll be happy to answer it, so you can be sure if the Revolut services will work for you as well.

Liked this Revolut review? Here are some more useful travel tips:

- Perfect Weekender Backpacks: CabinZero vs. Doughnut Comparison

- Multipotentiality – how to accept not being a specialist and actually love it?

- 30+ Worst Travel Planning Mistakes That Ruins Your Fabulous Vacation

- Lovely Family Vacation Quotes: 29 Citations to Inspire Family Travel Spirit

Like it? Pin it!

Dominika is a founder of Sunday In Wonderland and she recently switched her life to be local independent. She aims to travel the world and admire all of its wonders. She is much focused on sustainable life, self-development and making this world a better place.

4 Responses

As my holiday flight with British Airways to USA has been cancelled, & I’m getting a full refund. Can I get a full refund on my travel insurance of £72 ???Tere

Hello Terence,

Did you make your payment for the flight with the Revolut card? If yes, then I suppose you should get a refund to exactly the same card. You can read more directly in Revolut support by clicking here. If you made a payment with another card, and now you want to receive the refund to your Revolut card, I suppose you should contact the airline company to redirect the payment.

Terrible support! Reinstalled app and they blocked my card and app. No way to get in contact with them. Waiting in bot chat with days. It is useful as a support card. Not the main one.

I’m sad to hear that. No one’s perfect, although I had only good experiences with this company do far. But as I mentioned, Revolut is a good solution for an additional support and the way of exchanging currencies. And not keeping on all the money on this one card. But thanks for your comment!